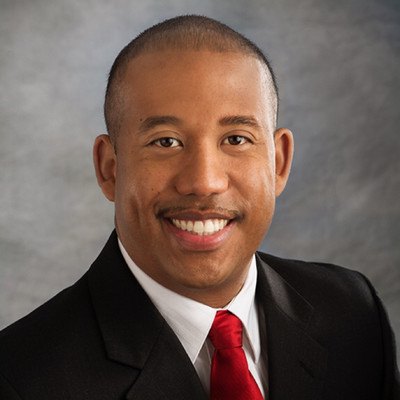

At ICBA LIVE this year, I had the pleasure of participating in a panel with Kimberly Kirk, Executive Vice President, Chief Operations Officer at Queensborough National Bank & Trust Co., a $2 billion-asset institution based in Louisville, Ga.; and Todd Michaud, CEO of HuLoop Automation, to discuss artificial intelligence (AI) and intelligent automation and how it supports a more efficient banking infrastructure.

We had such great feedback, we reconvened for a debrief, and what follows is an excerpt from that conversation.

The path to AI

Royal: We’re hearing more and more about intelligent automation and AI. How are these technologies taking shape in banks?

Kirk: We’ve used robotic process automation (RPA) for eight years now in a variety of ways. For instance, we leverage it for maintenance changes, and rote, routine tasks, like statement generation. We also introduced it during the pandemic for the PPP process, and not too long ago, we were victim of a BIN attack and had to reissue 43% of business debit cards. We employed RPA to get new cards activated and close old ones.

Michaud: These are excellent examples. Within a bank, at least 30% of existing employee capacity is being wasted on mundane, repetitive work. Intelligent automation, which includes intelligent document processing, automation of workflow, and an array of automation capabilities, helps banks solve problems with more efficient solutions. RPA is the first generation of this sort of technology, but it’s evolving.

Crawl, walk, run toward AI solutions

Royal: And with that kind of change comes uncertainty. When there are unknowns—particularly in compliance and regulation—it can be daunting for banks, but they don’t need to be afraid to start on the AI journey with intelligent automation.

Michaud: You’re right, Ken. Community banks are going on an automation journey, and they need to crawl, walk, run, and then fly. During the crawl phase, a good rule of thumb is to identify five-to-ten simple automations that they can do in 90 days. What are the quick wins that deliver ROI?

Interested in discussing this and other topics? Network with and learn from your peers with the app designed for community bankers. Join the conversation with ICBA Community.

On the compliance front, we talk a lot about regulator-friendly AI. The main point: You need to have a policy in place. Regulator-friendly AI is all about putting down guard rails for security, privacy, resilience, explainability, and transparency. When we build an automation, we do it with all of this in mind.

Kirk: As a former regulator, I’ve always said, “If you write it down, it happened, and if you didn’t, it didn’t.” Innovative technologies don’t have to be scary from a compliance standpoint if you document what you’re using them for, who has access to them, and so on.

We heard from regulators that we need to treat RPA bots like humans, identify how they have access, when they have lock-out hours, where are they housed, what staff have access to edit and write their scripts, and what back-end controls we have in place. But this is just regular risk management.

Phase 1: Phase out repetition

Royal: And the million-dollar question: Where to begin? Certainly, repetitive tasks are a good place to start. My team’s learning this firsthand. We’ve partnered with HuLoop for automation efforts, and we already documented our challenges, pain points, and time wasters and updated SOPs. We also went through a process mapping exercise and have established a blended rate so that we can show the ROI of our investment in automation. And still more to come. But is that just unique to us? How should banks kick off?

Michaud: Anything related to lending lifecycle and loan management, or customer onboarding are good places to start. But really, it’s any maintenance-related function, where humans are taking content from documents and keying them into systems or overseeing routine transaction processing. These are areas that tend to be highly repetitive. When we’re engaged with a bank and help improve productivity and reduce cycle time, the bank experiences happier employees as well.

Kirk: RPA eliminates the human element of error, lowers staff time, and gives them a better experience. We have not eliminated any positions by using automation; it has just enabled the bank to do things that made a bigger difference without overtaxing employees.

Diving into the intelligent automation pool

Royal: At ICBA Payments, we’re already benefiting from our work with intelligent automation. I tell bankers all the time, “Don’t be afraid to dip your toe in.” The automation pool is fine.

Michaud: Agreed, the water’s warm, jump in! You don’t have to boil the ocean. Start small, have success, and expand.

Kirk: I agree. Start small, get a proof of concept, and make sure you can understand and use it. There’s a lot of opportunity.