When autocomplete results are available use up and down arrows to review and enter to select.

Scheduled Website Maintenance Alert: The ICBA website will undergo maintenance starting at 7 p.m. (Eastern Time) on April 28. During this period, access to profile updates and purchases will be unavailable. Normal operations are expected to resume on April 29. We apologize for any inconvenience this may cause. For urgent assistance, please contact info@icba.org.

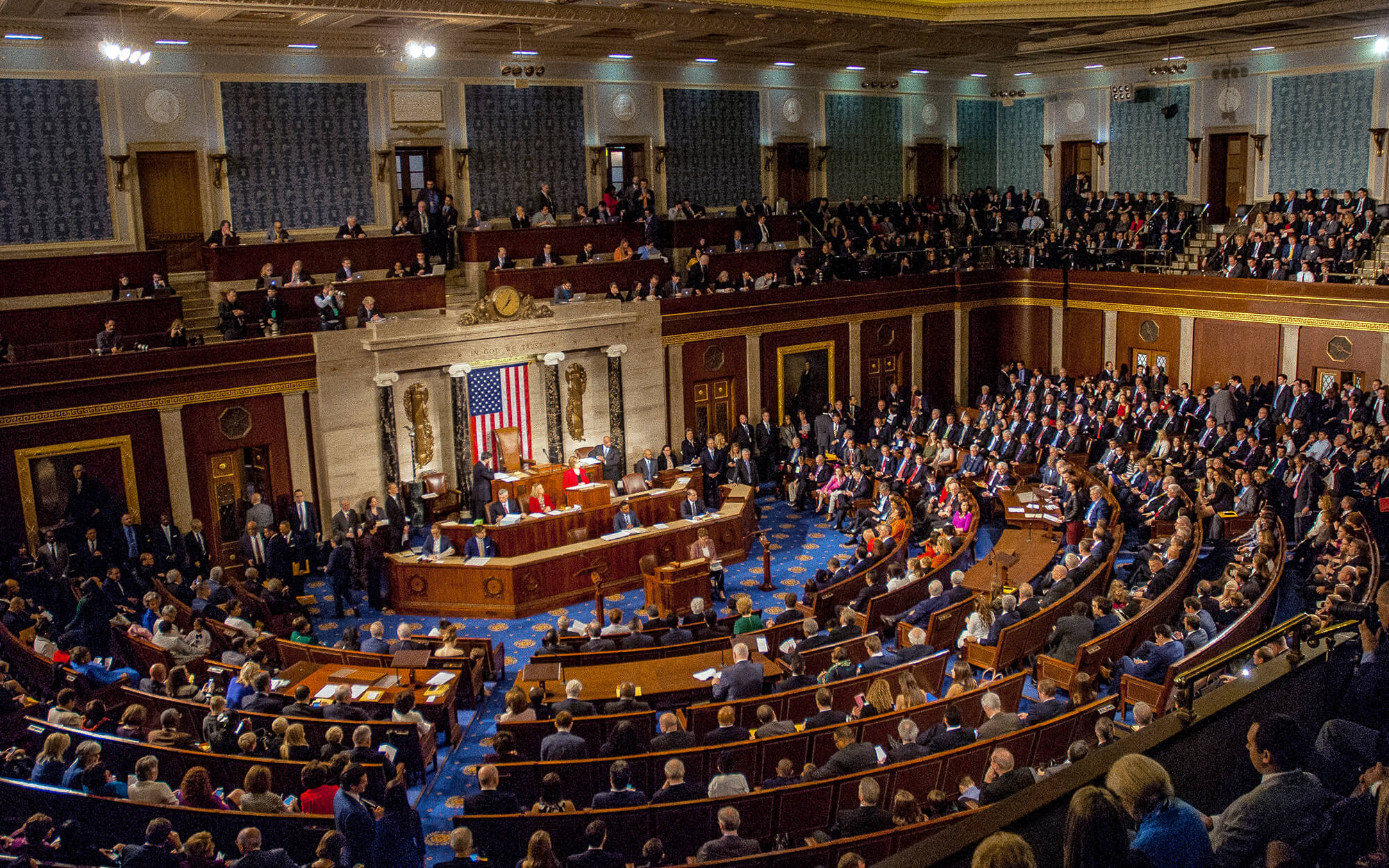

Though votes continue to be counted in several battleground states, major networks have now called enough states to give former President Donald Trump more than 270 electoral votes and a second term in the White House.

Republicans have secured at least 52 Senate seats and captured majority control of the chamber from Democrats in the 119th Congress, having flipped Democrat-held seats in West Virginia, Montana, and Ohio. A handful of additional Democrat-held seats have not yet been called, including Pennsylvania, Michigan, Wisconsin, and Nevada.

Control of the House may not be determined for several more days. Republican control of the House would result in unified control of the White House and Congress. Democratic control would produce a divided Congress that would effectively constrain some of President Trump’s more ambitious agenda items.

ICBA is fully prepared to press our advantage in the new government. We will meet with President Trump’s transition team and with every new member of the 119th Congress to advocate for community bank policy priorities.

The cyclical nature of party control makes it important to build strong relationships with elected officials and candidates from both sides of the aisle. ICBA is bipartisan, and we have spent considerable time and resources developing positive working relationships with members of Congress from both parties. ICBA PAC contributions have always reflected this practice.

Before the newly elected 119th Congress is sworn in on Jan. 3, 2025, the current Congress will return to Washington on Nov. 12 to take up unfinished, year-end business in a “lame-duck” session. The session will address the extension of government funding, which expires on Dec. 20, emergency relief for hurricanes Helene and Milton, and the National Defense Authorization Act (NDAA) for FY2025.

ICBA will continue to press for priority policy changes in the remaining days of the 118th Congress. In particular, ICBA will advocate for passage of the farm bill or targeted emergency relief for farmers, the SAFER Banking Act (S. 2860), and the Homebuyers Privacy Protection Act (S. 3502) as an amendment to the Senate version of the NDAA. We will work to block any effort to attach the Credit Card Competition Act or detrimental stablecoins legislation to a moving legislative package.

As he did in his first term, we fully expect President Trump to pursue a deregulatory and tax cutting agenda which could present opportunities as well as risks for community banks.

President Trump campaigned on trade policy, extension of the Tax Cuts and Jobs Act and additional targeted tax relief, and stricter immigration policy. Some of these policies require legislation and others can be accomplished through executive action, a power we expect him to use to the full extent.

If Republicans ultimately capture the House as well as the Senate, it is likely that they will use a reconciliation process (as they did in 2017 to pass the Tax Cuts and Jobs Act) to pass a new tax bill with a majority vote rather than needing 60 votes in the Senate.

If Democrats ultimately gain control of the House, reconciliation will not be an option, and the legislative environment will be constrained by divided government, narrow majorities, and the need for consensus.

What’s at stake in control of the Senate and House

The majority party in the Senate and House controls the chairs, hearings and legislative agenda of each committee, as well as the floor agenda. The Speaker of the House and Majority Leader of the Senate are effectively the gatekeepers for all legislation. A critical difference between the two chambers is that the House can pass legislation with a simple majority, while in the Senate 60 votes are often needed to break a filibuster and pass bills.

This means that we can expect the House to pass numerous party-line “messaging” bills that have no future in the Senate. On the Senate side, the narrow margin of control will constrain legislative action, though the majority (and to a lesser extent, the minority) will still be able to drive messages through hearings and floor votes with no expectation of passage.

Whatever the ultimate election results, there will be fewer moderates in the Senate Democratic Caucus, with the loss of Jon Tester (Mont.) and retirements of Tom Carper (Del.) and Independents Joe Manchin (W Va.) and Kyrsten Sinema (Ariz.), who caucused with the Democrats. The loss of moderates will make it more challenging to pass bipartisan legislation.

Importantly, Senate confirmation will be required of President Trump’s cabinet, sub cabinet, and agency appointments. This work could consume the Senate for much of the first quarter and possibly beyond.

Congressional leadership

Sen Mitch McConnell is stepping down from leader of the Republican party after 17 years in that position. A race to replace him will ensue among Rick Scott (Fla.), John Thune (S.D.), and John Cornyn (Texas). The election will be by secret ballot and is scheduled for Nov. 13.

Sen Chuck Schumer (D-NY) is expected to continue in his role as leader of the Senate Democrats, though a date for the election has not yet been scheduled.

As noted above, the Senate leader’s power would be curbed by his party’s narrow margin of control and possible Democratic control of the House. As a result, only bipartisan legislation will be signed into law. ICBA will continue to defend community banks from threats of harmful legislation and promote bipartisan policy favorable to community banks whenever possible.

If Democrats win control of the House, Hakeem Jeffries (D-NY), the current Minority Leader, is expected to become Speaker, though the election has not yet been scheduled. House Republicans are scheduled to elect a leader on Nov. 13. Mike Johnson (R-La.) is the presumptive Speaker or Minority Leader depending on control of the House.

New Senators in the 119th Congress (as of November 6)

This list does not reflect races that have not been called in Pennsylvania, Michigan, Wisconsin, Arizona, and Nevada.

Committee leadership

Senate. The Senate Banking Committee is expected to be led by Tim Scott (R-SC), the current Ranking Member. As noted above, Sherrod Brown (D-Ohio), the current Chairman, has lost his reelection. It is not yet clear who would lead the panel’s Democrats. Possibilities include Jack Reed (D-RI), Mark Warner (D-Va.) and Elizabeth Warren (D-Mass.).

There could be at least three open slots on the Democratic side of the Banking Committee.

House. If Democrats win control of the House, Maxine Waters (D-Calif.) is expected to resume her place as Chair. With the retirement of Patrick McHenry (R-NC), there is a contest to succeed him as Chairman or Ranking Member, depending on control of the House. Contenders for that role are Reps. French Hill (R-Ark.), Andy Barr (R-Ky.), Bill Huizenga (R-Mich.), and Frank Lucas (R-Okla.).

Policy opportunities. ICBA will vigorously pursue community bank regulatory relief and other priorities in the 119th Congress. Notably, we will press for legislation to provide relief from Dodd-Frank Act Section 1071, though passage would require 60 votes in the Senate. Once there is a new head of the Consumer Financial Protection Bureau (CFPB), ICBA will advocate for the repeal and reissuance of a revised 1071 rule, in addition to other priorities.

Subject to final results of the House races and control of that chamber, possible initiatives include significant increases in various bank regulatory thresholds, legislation to support minority depository institutions (MDIs), and advancement of legislation to close the industrial loan company (ILC) loophole in both the House and the Senate. Both parties in Congress and the incoming Administration are interested in promoting affordable housing, while Republicans favor a deregulatory approach and Democrats are more open to using federal dollars to address the problem. We can expect robust oversight and scrutiny of large banks and Wall Street institutions as well as non-bank competitors. Combatting fraud and scams will likely be a theme that cuts across both parties and chambers. A retail central bank digital currency (CBDC) is broadly opposed by Republicans and unlikely to advance.

Policy risk. While few of the legislative items cited below are likely to be signed into law, community banks will be exposed to policy risk from use of the congressional bully pulpit by influential lawmakers to promote ideas that are adverse to community banking.

Tax policy sharply divides the two parties’ governing philosophies. Thus, the election results bear directly on the policies that will be signed into law in the new Congress, though divided control of Congress would limit the range of possibilities.

Committee leadership

Senate. The Senate Finance Committee is expected to be led by Mike Crapo (R-Idaho), the current Ranking Member, and Ron Wyden (D-Ore.), the current Chair, will likely shift to Ranking Member.

House. If Republicans hold the House, Jason Smith (R-Mo.) is expected to continue as Chairman of the Committee on Ways and Means, and Richard Neal (D-Mass.) is expected to continue as Ranking Member.

Policy risks and opportunities. President Trump campaigned on a list of targeted tax exemptions. It is unlikely Congress would “rubber stamp” his more unconventional tax proposals. Moreover, record deficits and debt of $35 trillion will limit political support for ambitious tax relief.

Key provisions of the 2017 Tax Cuts and Jobs Act are scheduled to expire at year-end 2025. These include the individual rate structure, the 20 percent deduction for pass-through entities (including Subchapter S banks), the higher estate tax exemption, and the $10,000 cap on the SALT deduction, among other provisions.

The White House, Senate Republicans, and House Republicans, should they retain the majority, will seek to extend most of these provisions, probably using the reconciliation procedure. A Democratic House would force a compromise. That party generally seeks higher taxes on higher income taxpayers and a higher corporate rate. It is possible that no deal will be reached before year-end, even with unified government, and that the expiring provisions are temporarily extended for one or possibly two years, possibly with a higher SALT cap. Any long-term deal with Democrats would likely be a combination of extended tax cuts, a higher child tax credit, and revenue raisers.

ICBA’s goals are to preserve as much as possible of the TCJA (including the expiring 20 percent deduction for Subchapter S income), to maintain the corporate rate of 21 percent, to enact ACRE, to impose taxes on credit unions, and to block any “pay fors” targeting community banks.

Risks to community banks include: a corporate tax rate as high as 28 percent; higher marginal rates for higher income individuals; full or partial rollback of the passthrough deduction; higher capital gains rates; loss of step up in stock basis at death; and a financial transactions tax.

Senate. John Boozman (R-Ark.) is likely to become Chairman of the Agricultural committee and Amy Klobuchar (D-Minn.) the Ranking Member.

House. David Scott (D-Ga.), the current Ranking Member, is likely to become Chairman, and Glenn Thompson (R-Pa.), the current Chairman, is likely to become Ranking Member.

We expect a high turnover among members of the House Agriculture committee and among members in major farm districts, which means that we will have to educate these new members on community bank priorities.

Policy agenda. The farm bill is the unfinished business of the House and Senate Agriculture Committees. Unless a deal can be reached during the lame-duck session, the farm bill will rollover to the 119th Congress. ICBA priorities include adequately funding commodity prices, protecting crop insurance, enhancing USDA guaranteed loan programs, and blocking expansion of the Farm Credit System.

The writing of the new farm bill and its policy direction will likely be impacted somewhat by which party controls the House. If the GOP keeps the House, a new farm bill will be driven by the bill the House Agriculture Committee has already passed (H.R. 8467) which provides a significant boost to commodity reference prices. However, a Democratic controlled House could write a bill that ensures a greater emphasis on nutrition and conservation.

ICBA PAC plays a critical role in enhancing transparency within the political process, fostering collective engagement, and giving a voice in politics to key advocates like ICBA community bankers. During the 2024 cycle, ICBA PAC contributed nearly $1.5 million to over 320 federal candidates and committees who understand the challenges community banks face.

ICBA PAC supports industry allies on both sides of the aisle and across key congressional committees, especially when they are in tough races, not to be risk-adverse but to spend resources where they are needed most.

Powered by the support of over 3,100 individual contributions from community bankers, ICBA PAC strategically identifies opportunities to educate policy makers on our industry and strengthen the personal relationships between ICBA bankers and policymakers who champion Main Street.

We look forward to welcoming all ICBA PAC supported candidates as newly elected members of the 119th Congress. Our goal to educate all members on the value community banks provide to their constituents and communities will remain a top priority as ICBA PAC remains the nation's voice for community bankers.

The independent agency heads have fixed terms and are generally not replaceable by an incoming president until their terms end unless they choose to resign prior to the end of the term. However, an acting director is replaceable, as is the CFPB director and the Federal Housing Finance Agency (FHFA) director.

| Agency and Leadership | Term Ends | Replaceable by President |

|---|---|---|

| FDIC, Marten Gruenberg | 2028 | Yes, may be fired "for cause" |

| OCC, Michael Hsu | Acting | Yes |

| Federal Reserve, Jerome Powell | 2026 | No |

| CFPB, Rohit Chopra | September 2026 | Yes |

| SEC, Gary Gensler | April 2026 | Yes |

| FHFA, Sandra Thompson | June 2027 | Yes |

Coming soon: Analysis of 2024 election impact on community banking

Nov 6, 2024 | NewsWatch Today

Romero Rainey: ICBA Looks Forward to Working with Election Winners on Community Bank Policies

Nov 6, 2024 | Press Release