When autocomplete results are available use up and down arrows to review and enter to select.

Scheduled Website Maintenance Alert: The ICBA website will undergo maintenance starting at 7 p.m. (Eastern Time) on April 28. During this period, access to profile updates and purchases will be unavailable. Normal operations are expected to resume on April 29. We apologize for any inconvenience this may cause. For urgent assistance, please contact info@icba.org.

The center for cutting-edge financial technology and the driving force behind industry innovation.

The nationally acclaimed ICBA ThinkTECH Accelerator program promotes early-stage solutions designed specifically for community banks and the customers those banks serve.

The accelerator identifies and supports a variety of mission-driven, growth-stage providers through a proven methodology that rapidly validates and helps shape emerging industry solutions.

With this program, ICBA accelerates industry innovation by focusing on cutting costs, driving customer engagement, increasing revenue, and maximizing go-to-market strategies.

Since its inception in 2018, the ICBA ThinkTECH Accelerator program has connected the most innovative, cutting-edge fintech companies in the world with more than 1,000 community bankers and industry leaders.

Become more profitable, efficient, and competitive when you experience the Accelerator program in 2025. Register now to reserve meetings with six community bank solutions providers.

Register Now

Selling into banks presents a unique set of challenges, particularly for early stage fintechs. The ThinkTECH Accelerator Program enabled us to do two years of business development in 10 weeks.

— John Mizzi, co-founder and CEO of Vero Technologies

Through an immersive bootcamp program, your company will receive strategic planning, address business and finance challenges, and mentorship which includes:

Accelerator Application Process powered by F6S.

ICBA ThinkTECH companies also receive:

Applications are accepted on a rolling basis.

Apply Now Get informationLogo | Company | About | Cohort |

|---|---|---|---|

| Coverbase Inc. | Automates 90% of third-party risk assessments, allowing banks to focus on improving security and compliance. | 2024 (AP8) |

| Fin3 Technologies Inc. | Provides advanced solutions to reduce check fraud and streamline treasury operations for financial institutions. | 2024 (AP8) |

| Fintegrate LLC | An integration-as-a-service offering that reduces the costs and processes associated with technology integrations for improved operational efficiency. | 2024 (AP8) |

| Incent.net | A youth digital banking platform designed to help banks retain deposits and offer families valuable financial education. | 2024 (AP8) |

| Posh AI | An AI-driven platform empowering frontline banking staff to transform customer interactions with smart, conversational tools. | 2024 (AP8) |

| Vine Financial | An AI-powered commercial lending platform to help lenders focus on building relationships and achieving financial goals. | 2024 (AP8) |

“The accelerator’s ROI is immeasurable. The accelerator team lined us up with meetings with the Fed, CFPB, OCC, and FDIC - all on one day. I couldn’t have done that on my own.”

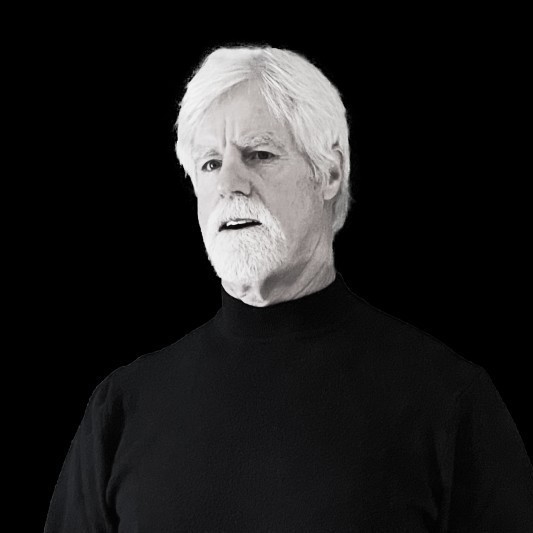

— Don Shafer, co-founder and co-CEO of Quilo

Logo | Company | About | Cohort |

|---|---|---|---|

| Accrue | Accrue by Core10 enables digital transformation for community banks, with digital lending, digital account opening for consumers and businesses, as well as integration-as-a-service for cores and other fintechs. Watch Demo | 2022 |

| Adlumin | Adlumin Inc. provides an enterprise-grade security operations platform that keeps organizations secure regardless of size or budget. Its patented technology gives organizations and solution providers everything they need for effective security, including SIEM, threat hunting, incident response, penetration testing, vulnerability management, darknet exposure monitoring, compliance support, and much more. | 2019 |

| AgentIQ | Agent IQ allows customers to engage with their bank like they engage with friends and family and enables banks to deepen relationships with each and every one of their customers. | 2021 |

| Agora | Agora Services offers financial institutions a robust and customizales cloud-based offering that enables banking customers to utilize and manage accounts in real-time. | 2019 |

| Azimuth | Provides automated full-population compliance testing that is faster, more accurate and cost effective | 2023 (AP6) |

| Beauceron Security | Beauceron Security reduces risk for organizations by moving individuals and teams from cybersecurity awareness into demonstrated behavior change. | 2021 |

| BotDoc | BotDoc's patented technology functions as the Fed-Ex of data. Using end-to-end encryption, Botdoc picks up the information from one user and drops it off at the correct destination. | 2019 |

| Chimney | Chimney is re-imaging financial guidance for the digital age. Chimney helps people make smarter financial decisions and get connected with the right products online, directly from their banks. Watch Demo | 2022 |

| CNote | CNote helps institutions invest capital into underserved communities at scale. | 2023 (AP5) |

| Conductiv | Collects additional lending and loan servicing data to incorporate into existing underwriting and lending processes. | 2023 (AP6) |

Applications for the Accelerator program open.

Initial applicant assessment to identify prospects with product concepts that are gaining traction, align with the program’s goals, and have strong market viability.

The Selection Committee, comprised of ICBA staff and member bank executives, whittle down the remaining candidate pool and determine the final group joining the Accelerator program through the “proof of concept” phase.

Kick-off event featuring cohort companies and financial regulators.

During a 12-week bootcamp, ICBA members participate as community bank mentors and share their industry challenges with the Accelerator cohort companies to mature the cohort products, pitches, and ultimately, ensure product-market fit and longevity.

Virtual ICBA ThinkTECH Demo Day and ICBA ThinkTECH Showcase (held during ICBA LIVE)—all cohort companies present their pitches to community bankers across the country.

The Selection Committee, comprised of ICBA staff and member bank executives, whittle down the remaining candidate pool and determine the final group joining the Accelerator program through the “proof of concept” phase.

See Committee Members