When autocomplete results are available use up and down arrows to review and enter to select.

Historically, the financial needs of minority and low-to-moderate-income communities were often ignored. Loan requests were frequently denied or approved with much higher interest rates and collateral requirements. Motivated by these discriminatory practices, which are collectively known as redlining, minority banks were formed to empower minorities and low-to-moderate-income communities by providing them with access to credit, capital and financial services.

Minority banks still play a crucial role to many minority and low-to-moderate-income communities and small businesses, often serving as the only safe option for them to do business. Without minority banks, many minorities and low- to-moderate-income customers would be susceptible to predatory practices, such as payday loans and car title loans that only keep them in debt.

Minority banks have a special skill set and understanding of cultural practices and norms that positions them to reach out to a cross-section of Americans—something majority-owned banks may not have. Minority bank shareholders, directors, officers and staff know and understand the culture and language of the communities they serve, allowing them to customize culturally sensitive products and services. For example, serving a community with first- and second-generation Chinese immigrants requires the ability to overcome issues of trust, language barriers, and customs.

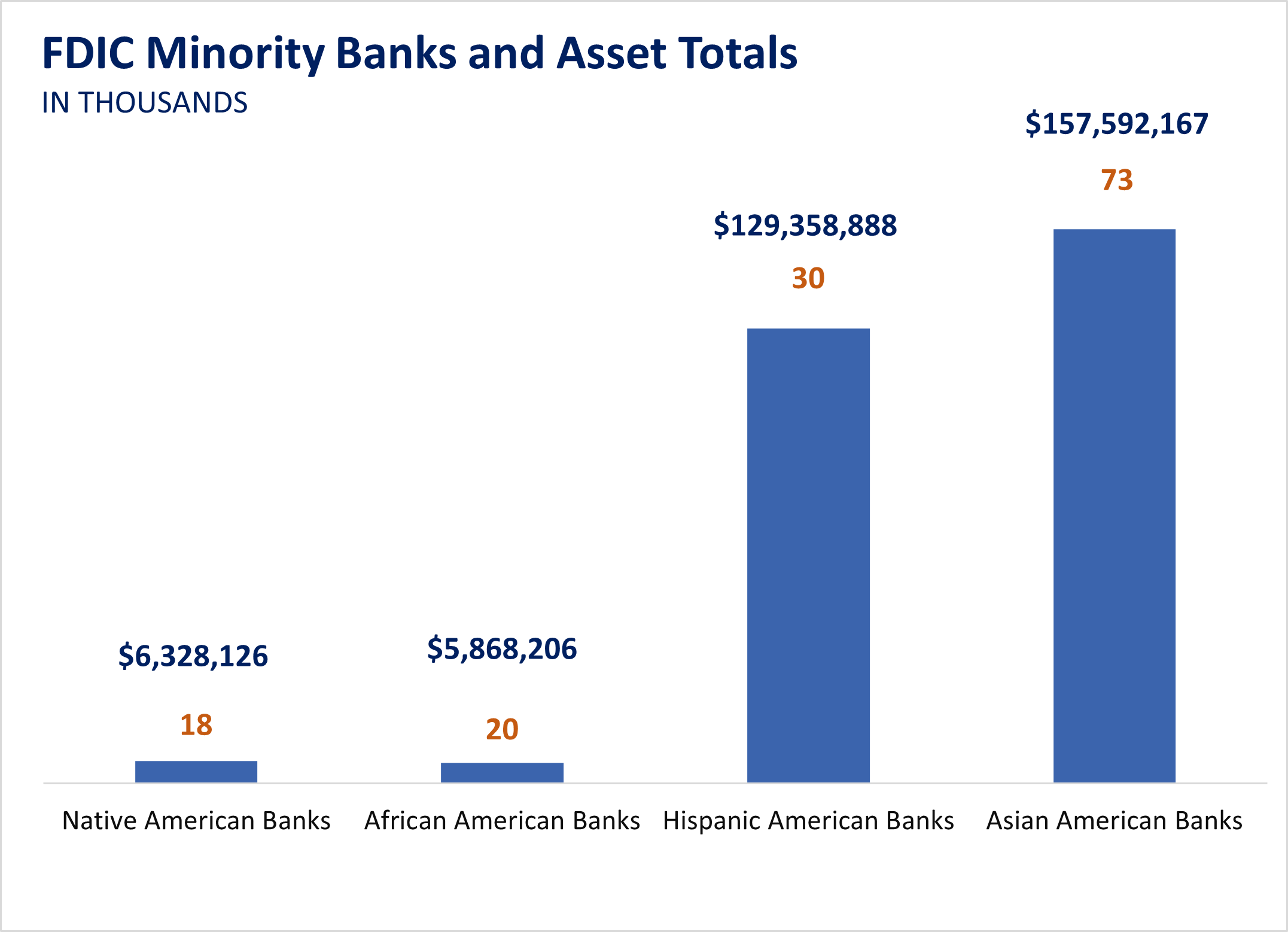

There are 145 FDIC-recognized minority banks serving minority and low-to-moderate-income communities. Although most minority banks operate in metropolitan areas, they are also located in rural and suburban areas nationwide. Minority banks range in assets from $15 million to $62 billion, with total assets of $329.4 billion; however, 105 of these banks are under $1 billion in assets, while 82 are under $500 million in assets.

There are 73 Asian American banks, 30 Hispanic American banks, 20 African American banks, 20 Native American banks and 2 multi-racial American banks. Asian American banks lead the minority bank industry with $174 billion in assets. Hispanic American banks are not far behind with $138 billion, followed by Native American banks at $7.9 billion, African American banks at $7.5 billion and multi-racial banks at $574 million. Forty-five percent, or 64, of FDIC-recognized minority banks are ICBA members.

While Section 308 of the Financial Institutions Reform Recovery and Enforcement Act of 1989 (FIRREA) includes provisions to help minority institutions grow and retain their distinct characteristics, the overall number of minority banks has continued to decrease in recent years.

Since the financial crises in 2008, 18 African American banks, 18 Hispanic American banks, 26 Asian American banks, 3 Native American banks and one multi-cultural bank have closed or merged with another bank, for a total of 66 minority banks. Meanwhile, few de novo banks have been established since the financial crisis to replace those that have closed.

Minority banks are small businesses themselves and are in need of capital to expand and continue lending. The high cost of operating in communities where education and per capita income is disproportionate to loan demand further challenges their ability to survive and attract customers that meet the regulatory agencies’ lending guidelines.

Minority banks also face the challenge of recruiting and retaining qualified employees, which is exacerbated by the exodus of many recent graduates lured away by better jobs and opportunities.

While Section 308 of the Financial Institutions Reform Recovery and Enforcement Act of 1989 (FIRREA) includes provisions to help minority institutions grow and retain their distinct characteristics, the overall number of minority banks has continued to decrease in recent years.

Since the financial crises in 2008, 18 African American banks, 18 Hispanic American banks, 26 Asian American banks, 3 Native American banks and one multi-cultural bank have closed or merged with another bank, for a total of 66 minority banks. Meanwhile, few de novo banks have been established since the financial crisis to replace those that have closed.

Minority banks are small businesses themselves and are in need of capital to expand and continue lending. The high cost of operating in communities where education and per capita income is disproportionate to loan demand further challenges their ability to survive and attract customers that meet the regulatory agencies’ lending guidelines.

Minority banks also face the challenge of recruiting and retaining qualified employees, which is exacerbated by the exodus of many recent graduates lured away by better jobs and opportunities.

Minority banks work hard to build strong communities in neighborhoods historically underserved and economically distressed. According to the FDIC’s study titled Minority Depository Institutions: Structure, Performance and Social Impact, minority banks originate a larger share of mortgages to properties in low-to-moderate-income census tracts and minority borrowers than do majority banks.

They finance small businesses to create jobs, make housing affordable, revitalize community facilities, and provide financial literacy and technical assistance to customers in low-to-moderate-income neighborhoods. Serving as catalysts for economic growth and revitalization, these mission-driven financial institutions have an intangible impact on the U.S. economy.

Making a difference in the community and having a positive impact in the lives of so many people is rewarding for minority banks. The ability to witness the growth of small businesses, provide credit to the unbanked and underbanked population, and build authentic and honest relationships with like-minded local customers provide minority banks with a sense of fulfillment and satisfaction.

Despite the constraints of their markets, minority banks use innovation and creativity to provide financial services in their neighborhoods, and their efforts should be recognized and supported more comprehensively by regulators and lawmakers.

Jan. 27, 2023

ICBA continued its campaign opposing changes to the Community Development Financial Institution certification application during a meeting with House Financial Services Committee Ranking Member Maxine Waters (D-Calif.).

Meeting: During Thursday’s meeting, ICBA President and CEO Rebeca Romero Rainey and ICBA Minority Bank Council Vice Chairman Carlos Naudon discussed the negative impact of losing CDFI banks’ certification—particularly those that have received Emergency Capital Investment Program funds. Waters acknowledged the importance of CDFIs and community banks, and she said she will help ensure ICBA’s concerns are heard by Treasury.

Delay: The CDFI Fund this week delayed the launch of the changes in the wake of opposition by ICBA and members of Congress. The CDFI Fund said it is postponing the launch of the new application beyond the previously anticipated April timeline and will announce a revised timeline “in the near future.”

ICBA Opposition: In a comment letter and congressional briefing last month, ICBA expressed opposition to application revisions that would rescind CDFI certification for banks that offer loans with annual percentage rates greater than 36% or originate balloon mortgages. ICBA said some community banks offer products with these characteristics due to the unique situation of their customers.

Congressional Pressure: ICBA and other groups later requested a meeting with members of Congress to discuss the revisions. Senate Banking Committee members Mark Warner (D-Va.) and Mike Crapo (R-Idaho) last week encouraged the Treasury Department to consider stakeholder concerns with the changes, while last month’s year-end omnibus directed the CDFI Fund to address CDFI concerns.

Outlook: ICBA will continue working with the CDFI Fund, Treasury, and Congress to ensure any revisions to the CDFI certification application are not detrimental to community banks and the communities they serve.