When autocomplete results are available use up and down arrows to review and enter to select.

Jan. 02, 2025

As the number of acquisitions of community banks by credit unions skyrocketed at a shocking rate in 2024, ICBA has rightfully sounded the alarm to legislators and regulators. As a community banker, an S Corporation bank leader, and an Employee Stock Ownership Plan (ESOP) bank owner, this issue presents a real and present danger to my community and local communities nationwide.

In support of ICBA’s calls for congressional action, I offer the following for consideration.

Community banks play a vital role in their communities, and ICBA’s calls for fairer tax policy reflects our commitment to ensuring a level playing field between tax-paying community banks and tax-exempt credit unions.

S Corporation banks like mine, along with those owned by ESOPs, are built to serve local economies and their shareholders. And despite misinformation from credit union industry groups, S Corps pay our share of taxes, unlike tax-exempt credit unions.

While taxes are part of the conversation, the broader issue lies in the mission creep of tax-exempt credit unions.

Originally chartered to serve specific community needs, many credit unions have strayed from their founding mission. Some now operate in ways indistinguishable from banks, despite having an entirely separate and often inattentive regulator, and they engage in practices that harm consumers and undercut Main Street businesses.

Their own regulator has called its lack of authority to supervise for cybersecurity risk a “regulatory blind spot.” And without the accountability measures of the Community Reinvestment Act (CRA), credit unions are not held to the same standards as community banks when it comes to meeting the needs of underserved areas.

Learn more about the CRA and why it matters here.

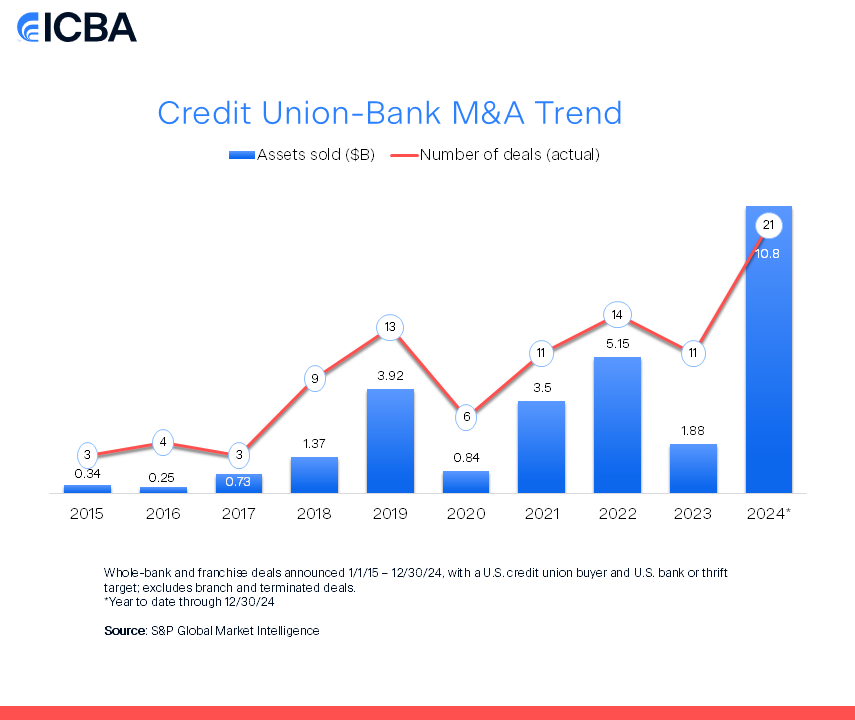

One of the most alarming trends is credit unions buying tax-paying community banks. These transactions, which reached an all-time high in 2024, undermine the competitive landscape and deprive communities of the high-touch, localized service for which community banks are known.

These expansion-oriented credit unions prioritize growth over genuine community service. This isn’t just a Main Street problem; it’s a national issue.

New ICBA polling conducted by Morning Consult highlights that this concern is not limited to community bankers:

64% of Americans believe that credit unions operating like banks should pay taxes like banks.

62% believe Congress should investigate whether the credit union industry’s tax and regulatory exemptions are still warranted.

These findings underscore that Americans support fairness and accountability in the financial system.

And policymakers and the news media are also taking note, with:

The FDIC approving a new statement of policy on bank mergers that for the first time explicitly states that additional scrutiny may be needed for deals involving credit unions.

Federal Reserve Governor Michelle Bowman noting that regulatory disparities between community banks and credit unions distort competition.

Reports by Bloomberg, CNBC, Axios, and CNN illustrating the growing momentum for credit union policy reform.

ICBA’s #OneMission priorities aim to continue bringing this issue to the forefront and advocating for reforms that benefit Main Street businesses and consumers.

I’m grateful for the opportunity to engage in these discussions and shed light on credit union practices that harm communities. Together, we can ensure our financial services policies reflect the values of fairness, accountability, and support for communities across the nation.

For those interested in learning more or contributing to this movement, I encourage you to join ICBA’s efforts and stand with community bankers nationwide. Let’s keep the focus where it belongs—on serving our neighbors and building stronger local economies.

Two easy ways to get involved right now. Send a message to your representative asking Congress for a hearing on the National Credit Union Administration. Or reach out to me directly at bbolton@communityspirit.bank to connect and discuss ways you can get involved and be effective in bringing light and change to this important effort.