When autocomplete results are available use up and down arrows to review and enter to select.

Aug. 16, 2024

Finally, mercifully and happily, community banks are beginning to book respectable returns from their collection of bonds. And it stands to reason: Fed funds have been stuck at a 23-year high for every bit of a year.

We can use tired old yarns about the burgeoning improvement—rising tides, blind hogs, etc.—but the fact remains this is an environment that you’ll probably be wishing for in the future.

This factoid may surprise you: Community banks’ portfolio yields are now at their highest level since at least 2007. There are reasons why it doesn’t seem like the bonds are carrying their share of the weight. For one thing, portfolios have shrunk in the past two years. According to the FDIC, total investments owned by community banks are down 15% since 2022, even as total assets have pretty much run in place.

Another reason—more tangibly—is that costs of funds have skyrocketed, so the spread between income and expense has dwindled. Still, there are lots of opportunities and plenty cause for hope as we enter the third quarter of 2024.

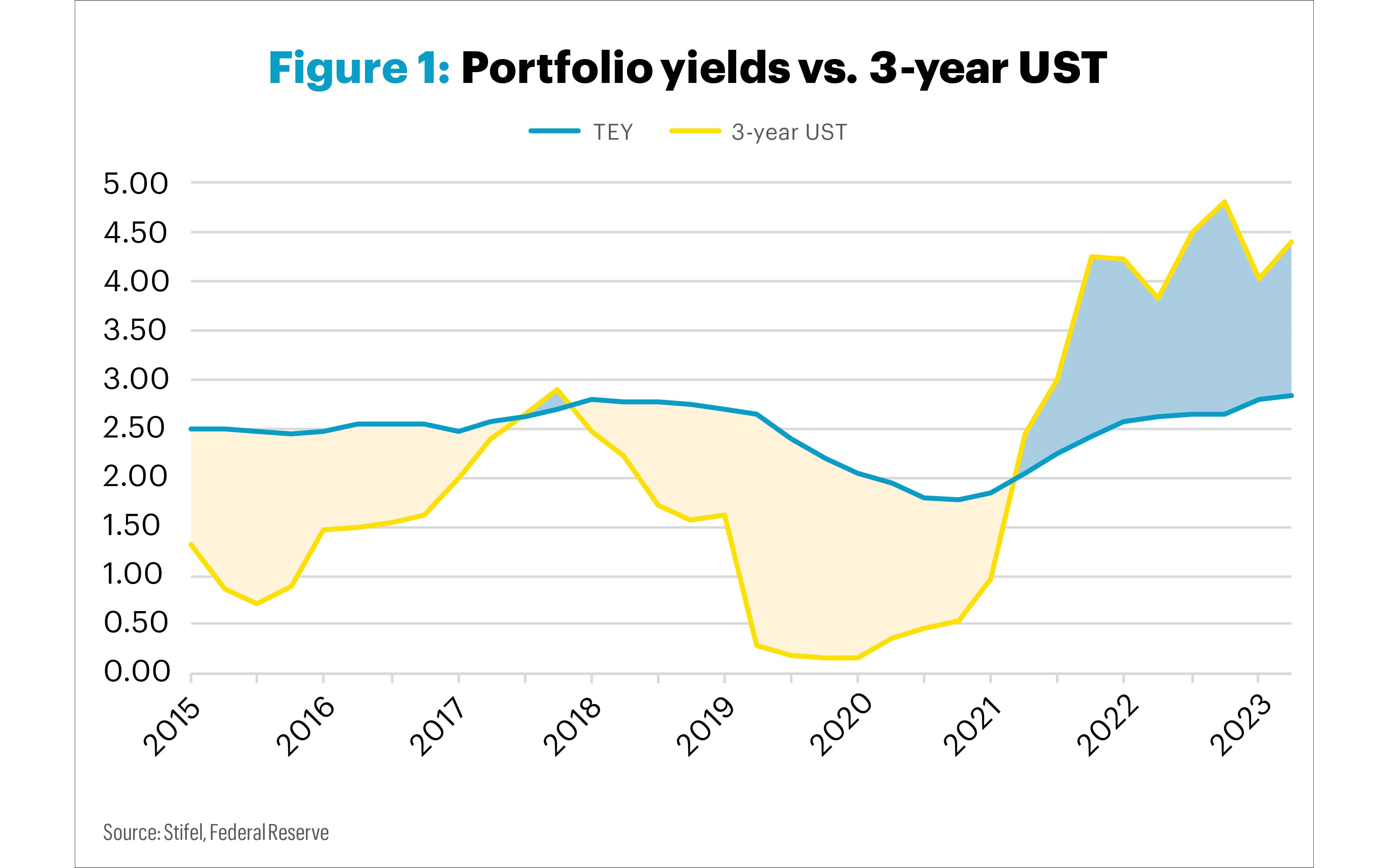

The Figure 1 graph (right) shows just how far the bond market has run in front of bank securities portfolios. The data series for portfolio yields come from the more than 400 community banks who use Stifel, ICBA’s exclusively endorsed broker, for their bond accounting.

When compared with the historical yields for the three-year treasury note, we again are in new territory. Historically, a bank’s own bonds yield more that similar-maturity treasuries, which makes perfect sense. Most bond portfolios consist of securities that have yield spread over and above treasuries, such as mortgage-backed securities (MBS) and tax-free municipals.

Since 2022, however, quite the opposite has been the case. Not only are treasuries available at higher returns than seasoned “spread” product; the difference is also quite noticeable.

While all of this may be painfully obvious to you portfolio managers out there, this does drive home the point that current market yields are historically very attractive.

A similar cause-and-effect is taking place in the housing finance market. The rapid rise in costs for any and all mortgage products in 2022 and beyond has had profound effects on community banking at several levels.

For institutions that have full mortgage lending operations, loan volumes for both new purchases and refinances have been barely a trickle of that experienced in 2020–2021. In turn, the dearth of refis and new closings has caused seasoned loans, and seasoned MBS pools, to throw off next to no cash flow in the past two years. The entire 30-year mortgage market, which accounts for 85% of all loans on single-family residences, has averaged annual prepayments of barely 5% for more than a year.

This also is nothing new. What makes the story a little bit different this cycle is just how far out-of-the-money most current mortgage loans are from being “refinanceable.” At the moment, the gap between 30-year loan rates and the average outstanding borrowers’ rates is well over 300 basis points (3%), which is really more of a yawning gulf that may be around for quite some time. A couple of Federal Reserve easings, when and if they come, will narrow that gap, but with all that ground to cover, it looks like we’re in for a long road trip.

So, believe it or not, portfolio yields have recovered pretty well. As of March 31, the average tax-equivalent yield was up to 2.83% after bottoming out in September 2021 at 1.77%. Every month, some bonds with 1%-something yields are rolling off and hopefully being replaced with “five handles” (5%‑plus yields).

As a final reminder, call protection, in the form of non‑callable bonds or those with deep discount prices, will probably be your friend in 2025. That can help your portfolio not just to catch up but to get ahead.

Balance sheet webcast in August

ICBA Securities and its exclusive broker Stifel will host their Quarterly Bank Strategy webinar on August 8 at 1 p.m. Eastern. Several strategists and economists will make presentations, and up to 1.5 hours of CPE are offered. For more information and to register, contact your Stifel rep.

CFO Forum this month

ICBA Securities is sponsoring and speaking at the 2024 ICBA CFO Forum. The event will be in Indianapolis, August 26–27. Up to 12 hours of CPE are offered. For more information and to register, visit icba.org/events