When autocomplete results are available use up and down arrows to review and enter to select.

July 16, 2024

Like many things in life, portfolio management is an endlessly frustrating endeavor. After navigating a complex web of competing objectives, policy guidelines and uncertain market conditions, a whole host of challenges may cause portfolio performance to differ meaningfully from initial expectations.

Unfortunately, many of those challenges became reality over the past several years. In 2020 and 2021, record-low interest rates, heavy deposit inflows and lackluster loan demand created a perfect storm where bond portfolios had to be built—often in considerable size—during what was quite possibly the worst investing environment that anyone reading this column has ever faced. To make matters worse, the historically rapid ascent of policy rates from 2022 to 2023 created sizable unrealized losses on these portfolios shortly after they were constructed, causing considerable stress at many institutions.

Though 2024 might seem relatively calm by comparison, a difficult operating environment remains given that the five-year Treasury rate is near its highest level in more than a decade and the yield curve is experiencing one of the longest and deepest inversions of the past 47 years.

Despite these challenges, you may be asking, “But my portfolio’s mark-to-market will get better over time, won’t it?” With the season of summer road trips fully upon us, addressing questions like this in asset-liability committee (ALCO) or investment committee might feel a bit like hearing “Are we there yet?” from the back seat of the car shortly after pulling out of the driveway.

Although there may not actually be a correct response to either question, I hope to help address questions from board members, executives or investors/owners in a way that facilitates productive dialogue rather than simply kicking the can down the road. Absent any rate moves, management teams are often surprised how long portfolio mark-to-market losses are carried into the future. But there are some common pitfalls to avoid in approaching the conversation.

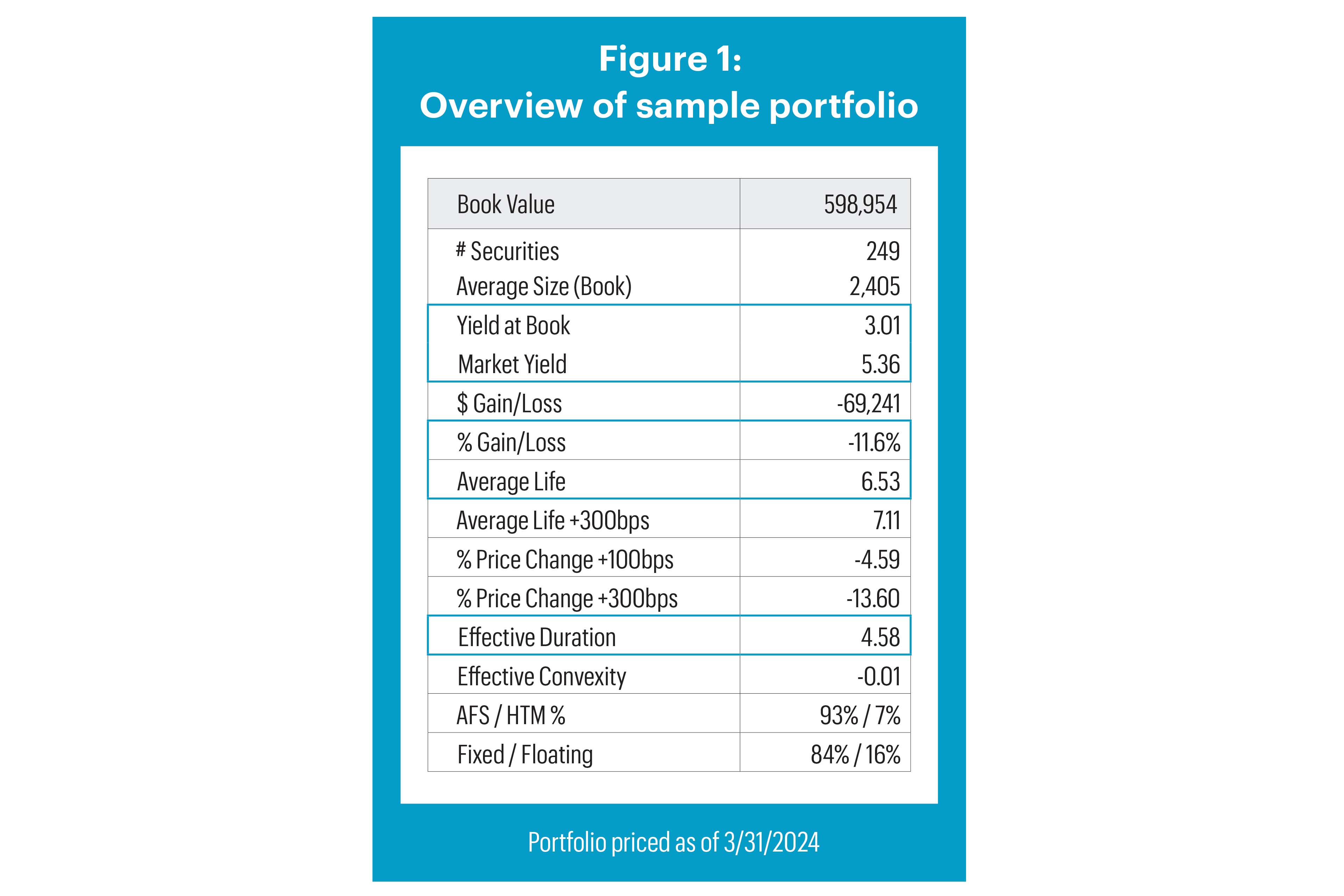

To explore this further, let’s examine a sample portfolio that is broadly representative of industry averages based on a variety of factors (yield, gain/loss, duration and sector composition). An overview of the portfolio is shown in Figure 1 (below).

Your portfolio may look somewhat different from the sample, but a key part of this discussion centers around the general concept of duration rather than the particular characteristics of an individual portfolio. So, please bear with me.

Management teams frequently use duration to estimate how portfolio marks will move due to changes in interest rates. Based on our sample portfolio’s effective duration of 4.58, one can reasonably assume that its price would decline by roughly 4.6 percentage points if interest rates increased by 100 basis points. Though there is some nuance to why actual marks could differ from projections, this is an entirely appropriate application of the concept—and, quite simply, it is precisely what duration is designed to do.

But management teams often extrapolate that thought process to estimate mark-to-market roll-off in a similar fashion. It seems intuitive to think one can divide our sample portfolio’s mark-to-market loss of 11.6 percentage points by its duration of 4.6, leading to expected price improvement of roughly 2.5 percentage points per year (or just over $15 million per year).

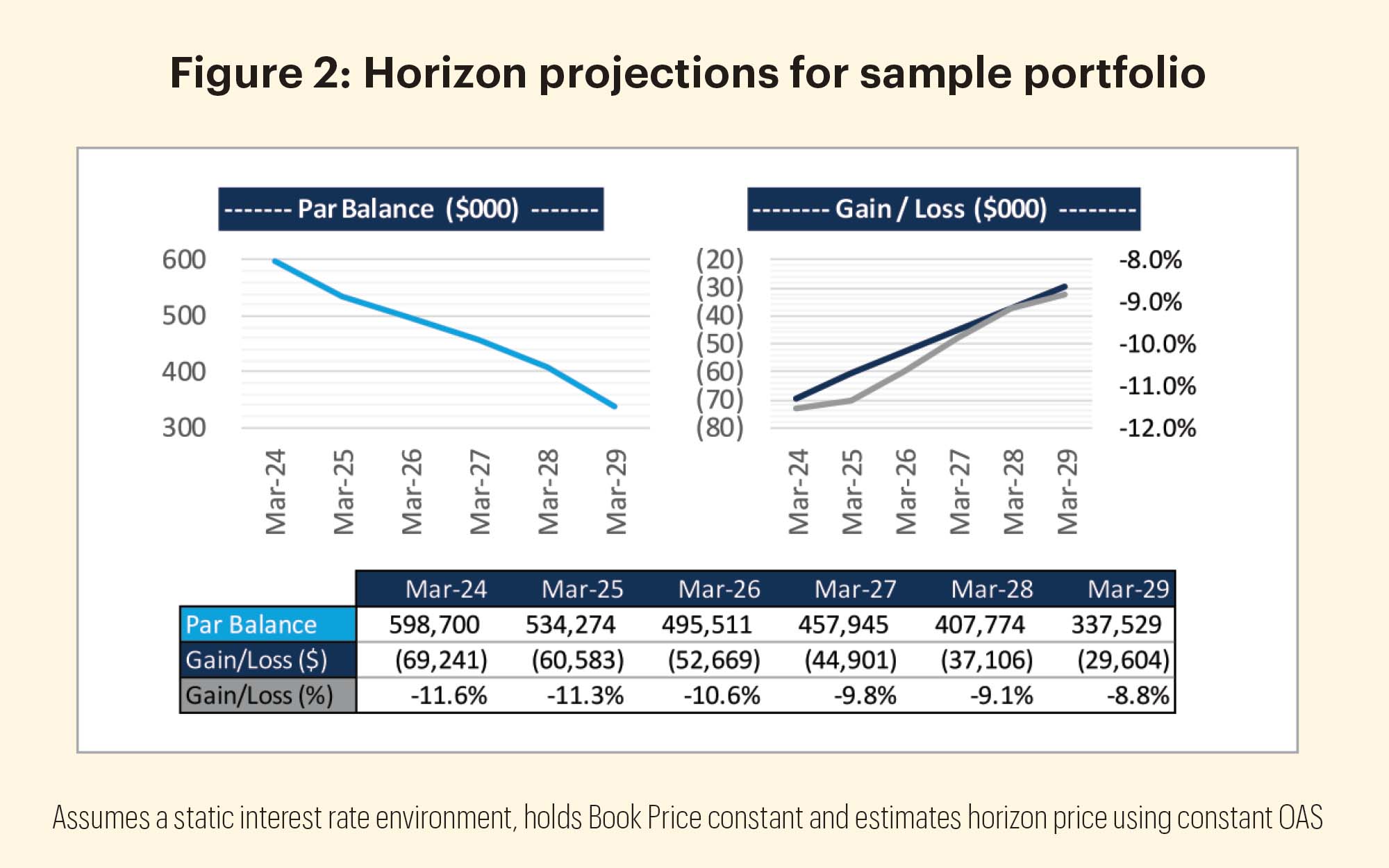

However, a closer look shows that using duration to estimate mark-to‑market roll-off can create misleading results. Figure 2 (below) explores a horizon market value analysis on our sample portfolio that provides a more realistic depiction of how mark-to-market will evolve in future years.

Of particular note is that $29.6 million of loss remains outstanding after five years, representing nearly 43% of the portfolio’s beginning loss position. Furthermore, the average annual decline in mark-to-market is $7.9 million over this period—roughly half of the “expected” decline based on portfolio duration. Naturally, this can be quite jarring for managers who expected mark-to-market to move back to neutral within five years!

The reasons for the variance between actual versus “expected” movements in gain/loss needs a more in-depth dialogue than can be provided in this issue’s column, but it largely boils down to the fact that market price improves at a considerably slower rate than the simple, duration-based calculation would suggest. Though percentage loss does improve each year in this example, the slow pace of improvement suggests that reductions in the dollar value of mark‑to‑market losses are primarily driven by principal paydowns rather than price appreciation.

The relative importance of longer-than-anticipated mark-to-market persistence will depend on many factors specific to your institution—risk tolerance, capital and liquidity positions, profitability outlook, and interest rate risk profile, to name a few—as well as market factors that are beyond your control. However, a better understanding of the portfolio’s trajectory is a crucial first step in evaluating appropriate responses. And with that burden lifted, you can spend more time thinking about the next family road trip.