When autocomplete results are available use up and down arrows to review and enter to select.

Feb. 16, 2024

“February made me shiver…”

—Don McLean

You may recognize the above phrase from the iconic 1970s hit song “American Pie.” It seems the singer was reminiscing about the 1959 plane crash that claimed the lives of Buddy Holly, Richie Valens, the Big Bopper and the pilot, Roger Peterson. But perhaps the thought can be adapted to what may be in store for bond investors in 2024.

If, in fact, the Fed’s Federal Open Market Committee (FOMC) has reached a point where it has stopped raising rates but has no immediate plans to cut them, does that mean the bond market will be frozen in place this year?

There are many parallels to where we are now and the last time the FOMC took a break with Fed funds above 5%. Though not all the circumstances are the same, it may be worthwhile to see how the period from 2006 through 2008 played out. The hope is that

you may be able to better prepare your community bank’s balance sheet for the next phase in the interest rate cycle, whether it’s a freeze or a thaw.

ICBA LIVE learning labs ICBA Securities and its exclusive broker Stifel will present three Learning Labs at ICBA LIVE in Orlando next month on various topics relating to community bank balance sheets. For more information and to register, visit icba.org/live

In June 2004, the Fed chairman was Ben Bernanke. Under his direction, the FOMC raised rates from 1% to 1.25%. For each of the following 16 meetings, another quarter point (0.25%) bump was added to the total. Finally, in August 2006, the FOMC took a break, as the sum of the tightenings (4.25%) began to have the desired effect of cooling off a hot economy, particularly the housing market. Part of the statement released after the meeting mentioned that “economic growth has moderated from its quite strong pace earlier this year.”

Fast forward to September 2007, which was nine meetings later. The FOMC had seen enough of housing prices in free fall and cut rates by 50 basis points (0.5%). However, this represented the 21st century’s longest stretch of time between the first

pause and the first cut. Other toppy periods, in 2000 and 2019, lasted well under a year. So, this is our best example of “higher for longer,” which a number of current Federal Reserve Board members have declared as a possibility.

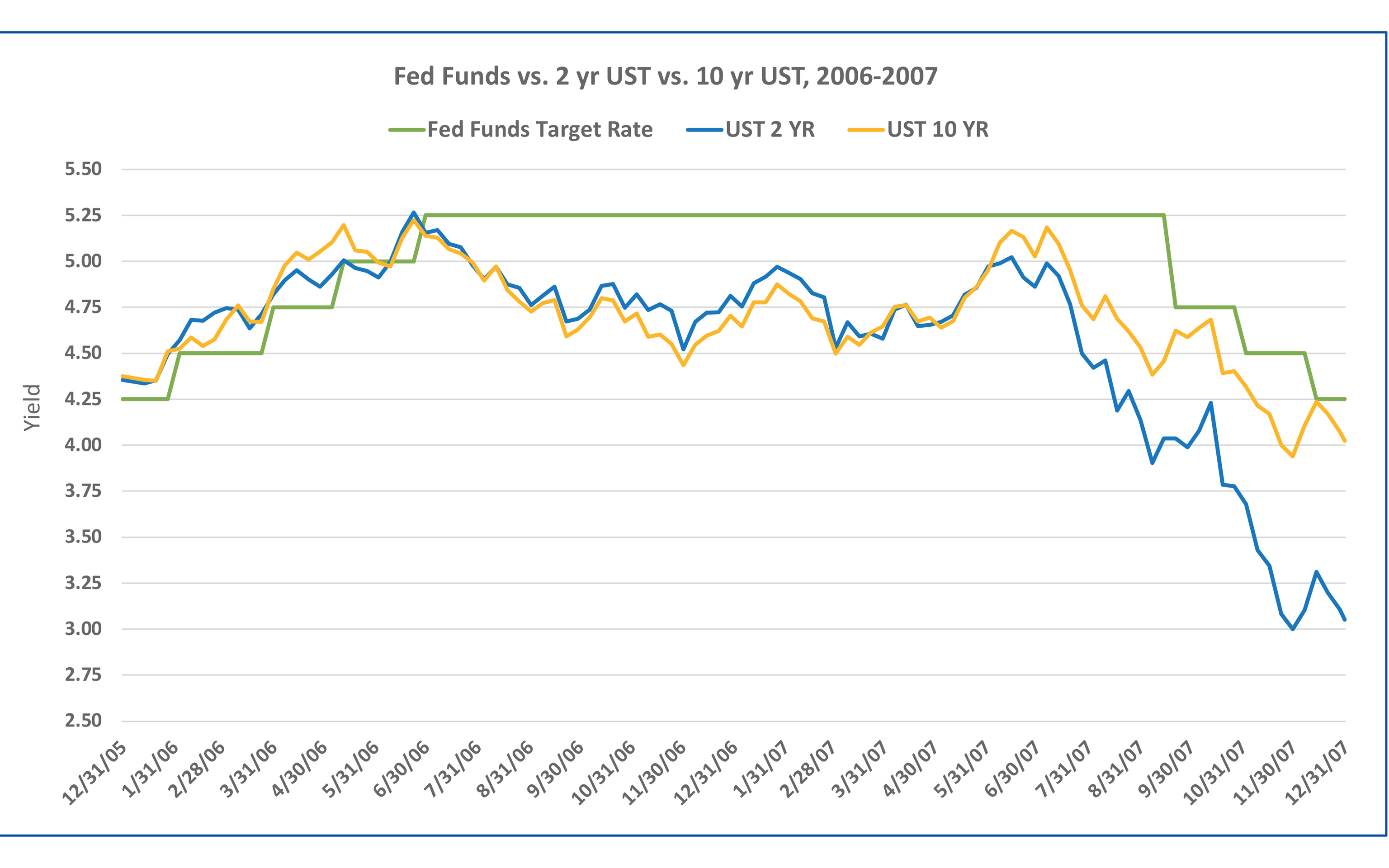

An interesting subplot to the “frozen” level of Fed funds from August 2006 to September 2007 is how the bond market performed. Again, there is a parallel to what we have at the present: namely, an inverted yield curve. As investors parsed the comments from the various Fed members, the market perceived that the next movement would be down, which caused 10-year yields to fall below the two-year. Though the inversion didn’t start until the Fed announced it was on hold in August 2006, it persisted for most of the pause, which, once more, was longer than an inverted curve normally exists.

Although the Fed’s rhetoric through the middle of 2007 continued to sound like it was more concerned about inflation than economic growth, the bond market was unconvinced. The two-year treasuries yield fell by more than 1% between July 6 and the

Sept. 18 meeting at which the first rate cut was announced (see Table 1). The curve also steepened its way out of its inversion and stayed that way for 11 years.

That September, the “thaw” to rates was just starting. The following calendar year of 2008 was terrific for bonds and dreadful for “risk assets,” including equities. Bond prices rose by more than 5%, and stocks dropped by over 30%. Once again, the inverted yield curve correctly predicted a recession. For four consecutive quarters beginning in December 2008, the economy printed negative gross domestic product numbers.

Your correspondent wants to be on record that he is not predicting a banner year for bonds, nor a bear market for stocks. There are still plenty of job openings, and though inflation seems poised to continue its retreat, it’s still a ways from the 2% target level. Our housing market is in far better shape that it was in 2007, and community bank lenders have plenty of capital and have done a remarkable job with risk management.

So maybe the takeaway is that the bond market can cover a lot of territory on its own without an actual rate cut, as we saw in 2007. That would light a candle under bond prices, which may be a welcome antidote to our midwinter weather and the notion of “higher for longer.”

Source: Bloomberg