When autocomplete results are available use up and down arrows to review and enter to select.

My favorite sport is ice hockey. My kids have been players since they were little, and my youngest is entering the North American Hockey League next season as a Bismarck Bobcat (shout out to my customers in Bismarck!). As we move into the NHL Stanley Cup Playoffs, and I move into a series of discussions on U.S. faster payments efforts, I am reminded of a quote from the great one, Wayne Gretzky. His now-famous quote has been used over and over—“Skate to where the puck is going, not where it has been.” When I think about faster payments, that couldn’t be more true.

As I begin packing to head to NACHA’s Faster Payments 2017 Conference (stop by our booth #705 and mention my blog and we’ll give you a special gift), I can’t think of a better place to start than Same Day ACH since it does predate the Fed Faster Payments Task Force. First, let’s explain why the ACH network is so important to payments. NACHA just released its 2016 stats, and ACH volume reached a staggering 25 billion in transactions totaling $43 trillion. Of that, 13 million credit transactions totaling $17 billion were same-day ACH, and that was only one quarter, given that Same Day ACH credits did not go into effect until Sept. 23! (To read the full story, click here.)

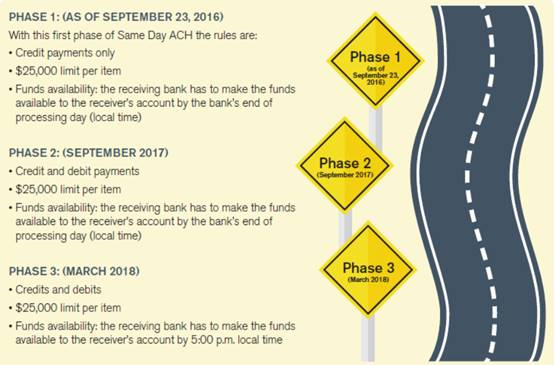

Keep in mind that Same Day ACH is being phased in through March 2018 with debit being added in September 2017 and funds availability required by 5 p.m. in March 2018. This is arguably the biggest change to the ACH network in years (remember IAT?). While I am sure more use cases will evolve as people come up with creative ways to use the ACH network, the primary use cases are still direct deposit (think about the forgotten adjustments for holidays and hourly workers), person-to- person payments, forgotten bill payments, and disaster relief funds (e.g., the floods in Louisiana or the fires in Tennessee). And now with the U.S. Treasury announcing its plans to participate beginning Sept. 15, 2017, the opportunities are even greater!

Remember, participation as a receiving depository financial institution is not optional, but origination is. If you are an originator, your processor can help you set up Same Day ACH services for your customers. For businesses, you can potentially charge a premium to originate a Same Day ACH file and generate some additional revenue. For more information on Same Day ACH, click here.

Also, May is Direct Deposit and Direct Payment Month, and the theme this year is Split to Save. Visit the website to get a free toolkit and educational resources. Speaking of May, next month I will provide an update on the work of the Fed’s Faster Payments Task Force. Stay tuned, and happy Same Day ACH, everyone.