When autocomplete results are available use up and down arrows to review and enter to select.

Your next step is to identify any and all corporate strategies at your bank that are payments related. Examples could be your bank’s delivery channels or perhaps a goal of increasing non-interest revenue. Next, you’ll want to concentrate on strategic areas of focus such as integration, improving client interaction and/or user experience. I always tell ICBA Bancard clients to:

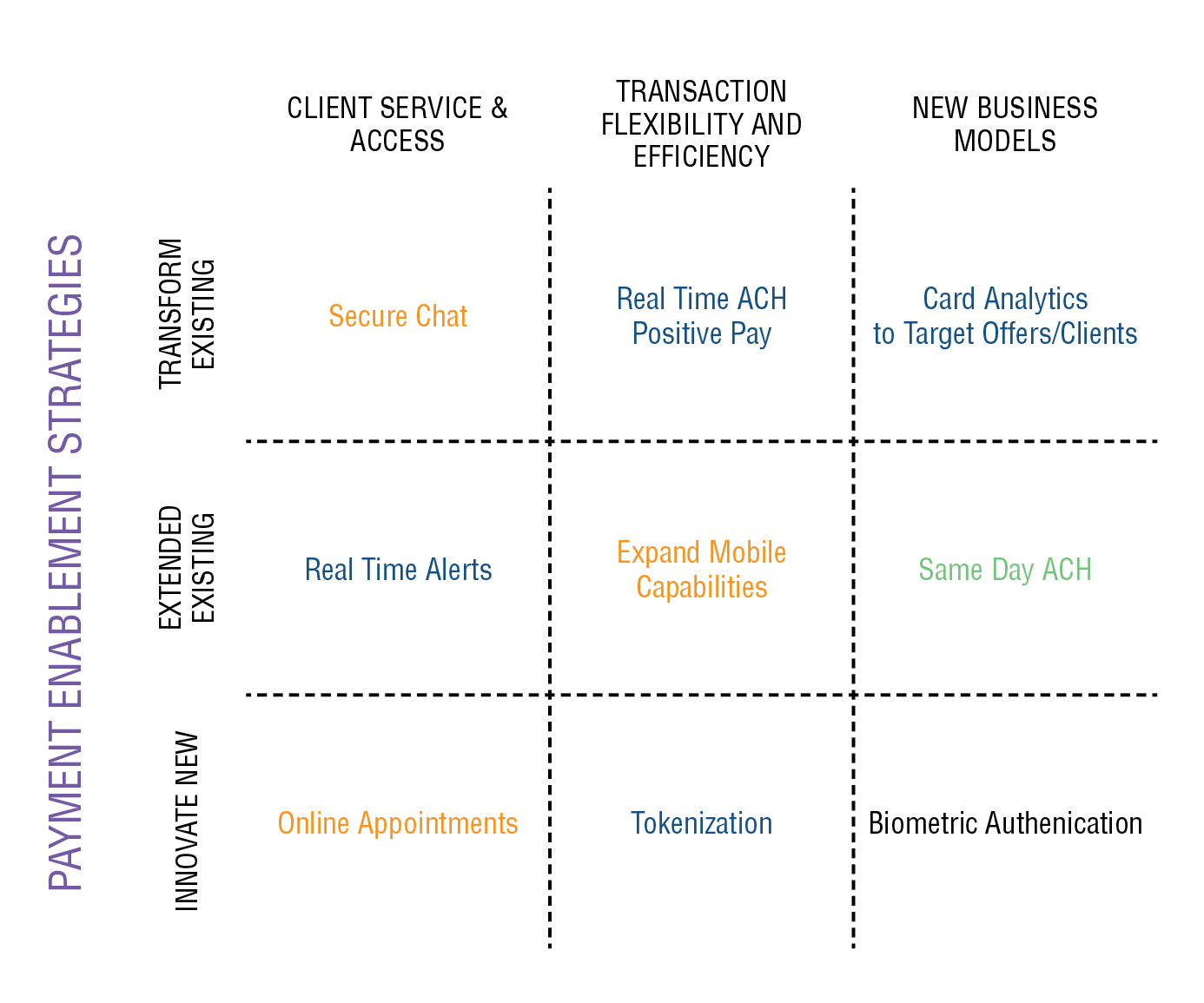

In my former role as a community banker, I always found it helpful to create visual aids to clarify complex relationships and concepts. In the example below, you can see how a bank’s payments strategy initiatives can be compartmentalized based on whether you are expanding an existing channel or innovating through new channels.

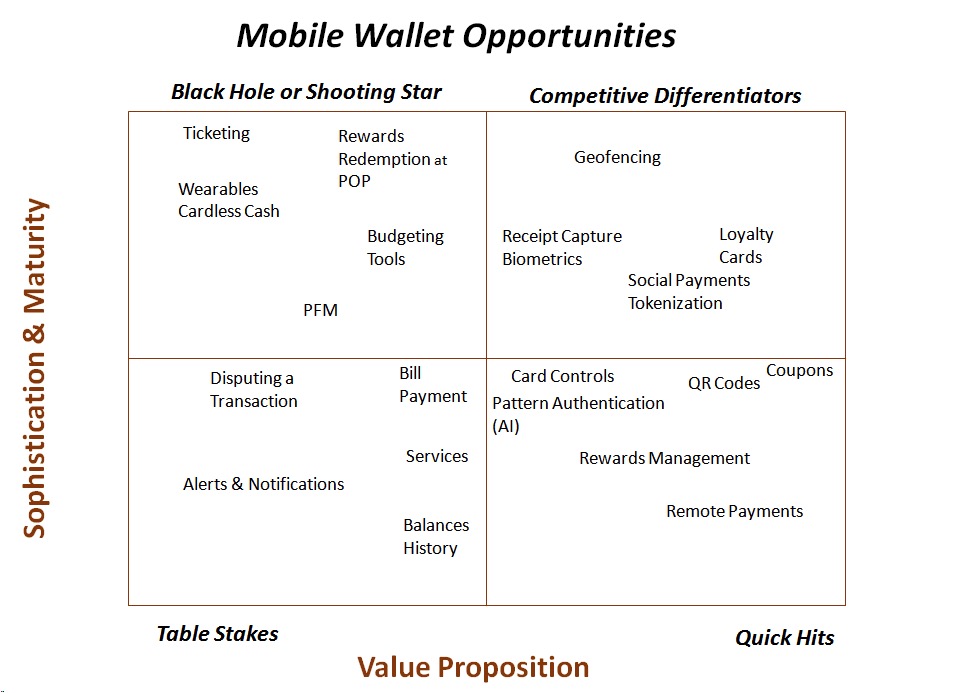

For a more complex or rapidly evolving product like mobile, you can use a chart like the one below to track and evaluate opportunities against your bank’s key metrics. In the example below, mobile wallet opportunities are examined and measured against pre-determined criteria such as: