People’s financial decision-making can be a head scratcher. Take savings, for example. It’s widely reported that more than half of Americans wouldn’t have enough emergency savings to cover an unexpected $1,000 bill.

Are we all irresponsible? Are the macro-economic obstacles so insuperable? Or are there other explanations for our failure to plan ahead?

“Economics is not a linear function of numbers; it’s a living discipline, because it incorporates emotions and instincts of people in the decision process,” says Dan Geller, CEO of Analyticom, a behavioral economics modeling firm.

The field of behavioral economics studies the cognitive biases and emotions that shape our decision‑making much more than we consciously realize. “Behavioral economics is simply a marriage between economics and psychology,” Geller explains.

In the area of savings, a phenomenon called temporal discounting helps explain why we sometimes don’t act in our own best interest.

“Research shows that when we think about ourselves in the future, our brain lights up like we’re thinking about a different person,” says Melina Palmer, CEO of The Brainy Business, which helps companies apply behavioral economics. “If a person is thinking about retirement or a car they’d like, it’s like asking somebody to care about their future self. But when the brain thinks, ‘That’s somebody else, not me,’ they are much less likely to take action.”

Goalsetter, a family and youth savings, investing and financial education platform, tackles temporal discounting in one of its videos. In the video, a young man packing for a spring break getaway is visited by his “future self,” complete with gray hair. Future self informs the present self that he’s still working because the present self didn’t save enough for retirement.

“Every time we show these videos, we hear, ‘Oh my gosh, that’s me,’” laughs Tanya Van Court, CEO and founder of Goalsetter. “Even the smartest consumers, if they are not given financial education, are on a path to making terrible financial decisions.”

“The basic concepts of behavioral economics are controlling 98% of everything that happens.”—Devon Kinkead, Micronotes.ai

Implementing gamification

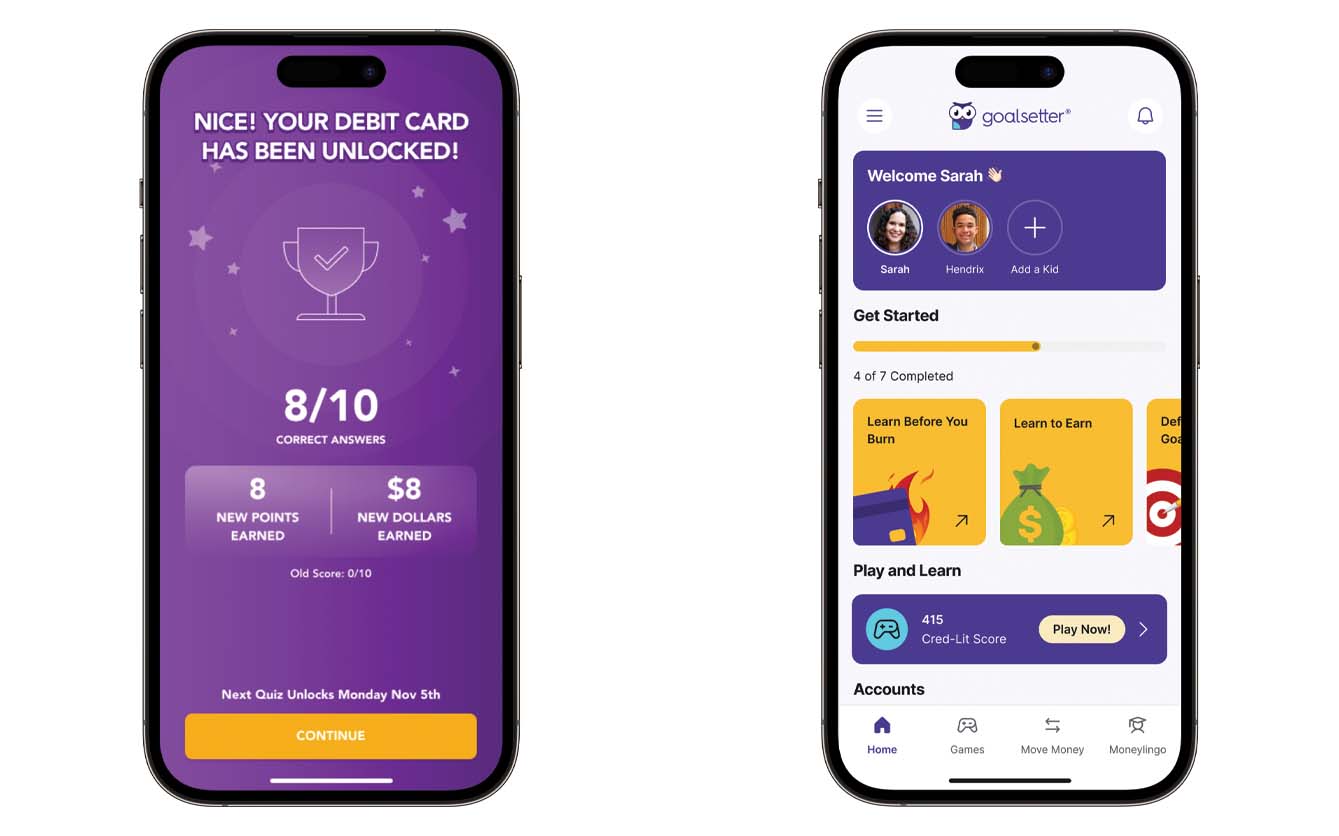

Manasquan Bank in Manasquan, N.J., is partnering with Goalsetter to offer financial education tools, including a debit card that parents can “freeze” weekly if the child hasn’t taken their financial literacy quiz.

“We teamed up with Goalsetter because we’re passionate about teaching the alpha generation the ropes of financial literacy and responsibility,” explains Catherine Franzoni, senior EVP and COO of the $3 billion-asset community bank. “The apps are fun, and it’s teaching good habits and a mindset of the need to save money for the future. … We feel this tool shows the alpha generation and their parents that we believe in them and will invest in them.”

WesBanco in Wheeling, W.Va., also saw the need for tools that promote better spending control, especially among children.

“We saw that parents were adopting nonfinancial institution-based solutions to help their children develop good financial habits,” recalls Jan Pattishall-Krupinski, EVP and director of operations for the $17.8 billion‑asset community bank.

WesBanco responded by introducing a debit card in two formats that allows parents to oversee their child’s spending. “One format is for younger children down to the age of eight where the parent controls how and where they spend, and another format is available at the age of 13,” says Pattishall‑Krupinski. “[They] give both parents and children some control.”

She adds that WesBanco sees this as a way to win the loyalty of the younger generation early on and, hopefully, create generational continuance.

Jake Fuchs, investor at BankTech Ventures, a strategic investment fund, points out that fintech tools like Acorns gamify savings to incentivize behavioral changes. “It’s providing the right levers to help people want to save,” he says. “A key point is that we all tend to have a present bias. Essentially, we’re biased to [expect] instant rewards.”

Fuchs adds that encouraging customers to save more also helps community banks that are eager for more deposits. “If banks can find a way to shift that behavior and incentivize behavior toward delayed [gratification], there’s a huge opportunity for savings and deposit growth,” he says.

Sarah Welch, managing director of personalization for Curinos, a technology and analytics company, emphasizes how emotionally charged financial decision-making can become. “Your finances are at the heart of security and your ability to live well,” she says. “Its importance is very, very high. It is emotionally fraught. We have all grown up with different meanings around finance. For some it’s straightforward; for some, it’s a sport. For some, it’s something they don’t want to think about.”

The psychology that drives customer behavior

Research into behavioral economics has generated numerous insights into how people make decisions.

Here is a sampling of some concepts:

Anchoring effect: The first number we encounter, such as the price of an item, will tend to be the reference point for all of our subsequent perceptions of whether prices are too high, represent good value or signal a “cheap” item.

Bounded rationality: Limits on time, information and mental capacity skew decision-making and incline people to shortcuts and “good enough” decisions.

Endowment effect: We tend to overvalue what we already own. If we’re given a coffee cup, we’ll turn around and attempt to sell it for more than we ourselves would pay to buy it.

Loss aversion: Psychologically, losing a $10 bill affects us more negatively than finding a $10 bill rewards us. To equal the emotional impact of the $10 loss, we’d have to find a $20 bill.

Framing: How choices are presented to us affect how we choose, even if the alternatives are the same. An example is 20% fat yogurt versus 80% fat-free yogurt.

Uncovering answers in data—and beyond

Bankers’ efforts to understand what drives customers’ decision-making can benefit from AI-driven technology, which has tremendous power to spot patterns and personalize offers. But bankers and industry observers agree that the real AI magic occurs when banks combine technology with the personal touch.

“Data provides rich contextual information about where a customer is, but it’s not exhaustive,” Welch says. “You’re not going to find out what emotional context a person brings to money or what goals they care about.”

Kent Landvatter, CEO of $610 million-asset FinWise Bancorp in Murray, Utah, agrees that data’s utility is to provide the groundwork for a personal understanding of customers. “I’m [data-driven], but knowing the customer isn’t just the BSA aspect,” he says. “What they need, when they need it and what they don’t need and advising them is what’s really important.”

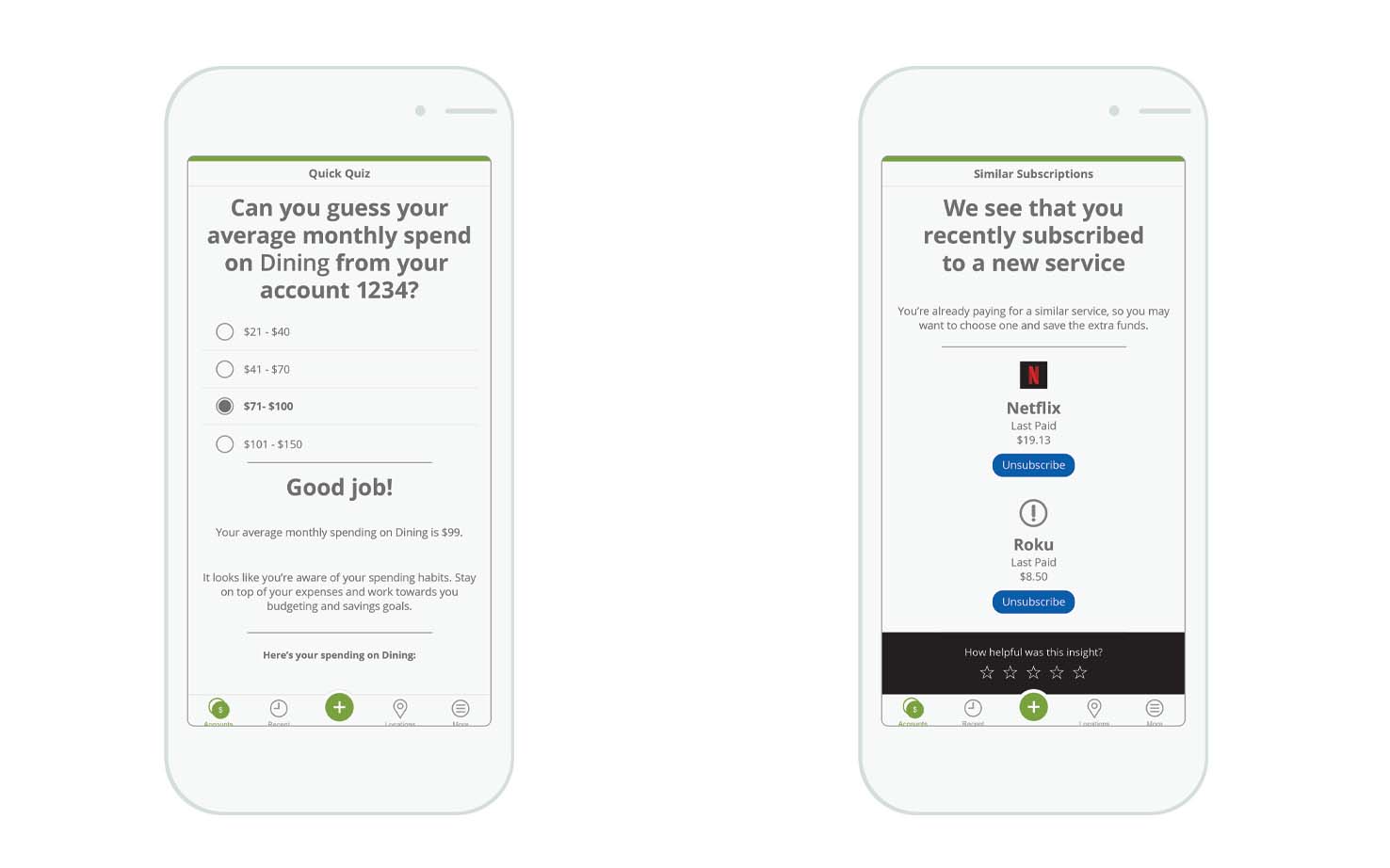

Union Savings Bank (USB) in Danbury, Conn., offers Spending Insights, an AI-based program that analyzes users’ normal spending patterns over a period of six months. The real payoff, according to Rick Judd, EVP, innovations and revenue, at the $3 billion-asset community bank, is that it helps bankers relate more effectively with customers.

“We have the face-to-face relationships in branches, and frequently small business lending turns into a personal finance discussion,” Judd says. “For us, the hallmark of our bank is a personal interaction, and we use these tools to deepen the relationships.”

Chris Barlow, VP, digital channels for USB, agrees. “Everybody’s journey is distinct and specific,” he says. “Being able to understand what your patterns are and how to improve your financial outlook is one of the key things we’re doing. Spending Insights is a differentiator for us.” Barlow adds that customer feedback about Spending Insights has been positive. “People are saying things like, ‘I like that Union is looking out for me and helping me to understand my finances better,’” he reports.

A bird’s-eye view of customer behavior

WesBanco provides dashboards to each banking center that show key behavioral elements of the client, such as adoption of digital behavior or loan products. “Any time a banker engages directly with a client, we are able to have a financial needs analysis guide the conversation,” Pattishall-Krupinski says. “This ensures our discussions tie back to that person’s unique financial journey.”

Points West Community Bank (PWCB) in Windsor, Colo., has teamed with Micronotes.ai, a cloud-based marketing automation solution, to track and analyze customer data for tailoring marketing and other customer communications.

Marin Olson, marketing director for $700 million-asset PWCB, says that the community bank has been surprised and pleased at how data analysis has driven greater customer engagement.

“We thought it would be more technology-driven and would dictate email or ad campaigns,” she says. “It’s done that, but we’re getting more information on individuals than we are on segments of people. It has changed our efforts to cross-sell. We aren’t just doing cold calls. We have data that a customer is interested in a product or service, and the branch manager already knows their name. We can approach them with exactly what they need.”

In Bruceton Mills, W.Va., $950 million-asset Clear Mountain Bank has partnered with Micronotes.ai and Experian on a cross-selling effort to customers who were deposit-only account holders.

The community bank paired prescreened mailing and digital offers with outbound calling, says Tim Broyles, chief experience officer. “We’ve seen good results from pairing the offers with a personal call from our branch network. The campaigns have yielded a 1.5% loans-booked rate [on average], which is very favorable.”

Devon Kinkead, chairman of Micronotes.ai, which uses machine learning to improve communication targeting, advises banks to make clear, detailed offers to build trust and improve response rates.

“If you say, ‘We can refinance your credit card debt into a home equity loan and save you lots of money,’ that gets one response level. If you [give them a specific number and APR and] say, ‘We can save you $33,000,’ that gets a different level of response,” he says. “The clarity of the value proposition helps the behavioral economics problem of distrust. We’ve found that if you give people specifics, it dramatically improves the performance of the offer.”

Want to learn more about behavioral economics?

Books:

Behavioral Economics: The Basics by Philip Corr and Anke Plagnol

Nudge: Improving Decisions About Health, Wealth and Happiness by Richard Thaler and Cass Sunstein

Predictably Irrational by Dan Ariely

Thinking Fast and Slow by Daniel Kahneman

Websites:

analyticom.com (includes insight on the Scientifically Predictable model for self-directed investors)

Podcasts:

The Brainy Business podcast

Masters in Business (Daniel Kahneman)

The personal connection

Trust is an area where community banks can have a competitive advantage. The Brainy Business’ Palmer urges community banks to stress their community presence as part of their brand. She says a differentiation strategy is the recommended route.

“If your prospects care about what you’re doing on a brand level, like what are you doing in the community, that will differentiate your bank from the big banks,” Palmer says.

Clear Mountain Bank emphasized its community connection when it launched a campaign to attract new customers. The bank included a banner with a picture of the local branch, pictures of its retail bankers and their contact information at the bottom of loan offers in digital pieces.

“People get inundated with these offers,” Broyles observes. “We’re showing the general public that this is a bank right here in my community. It’s right here where you live and work. You drive by it every day.”

FinWise’s Landvatter agrees that customer relationships give community banks a strong advantage. “The people at our branch have [very loyal] customers,” he says. “Keep doing what you’re doing with personal relationships, and that can be aided with [tech-empowered] financial tools such as the ability to cross-sell.”

Kinkead believes that to drive greater customer engagement, community bankers must make behavioral economics a priority.

“The basic concepts of behavioral economics are controlling 98% of everything that happens,” he says. “If you don’t understand why people behave irrationally, you can’t do anything about it.”

A guide for the financial journey

Union Savings Bank in Danbury, Conn., created the FutureTrack program to help customers reach their financial goals. It’s a highly personalized program staffed with certified “life stage” coaches who are trained to meet customers where they are and understand their unique financial picture.

“People can be very emotional about how they perceive financial decisions,” observes Chris Barlow, Union Savings Bank’s VP, digital channels. “FutureTrack coaches have deeper conversations, so they understand what’s really driving this behavior. Those conversations end up with better outcomes for our customers.”

Many customers are working to build their credit and improve their budgeting. “Our employees are so caring and committed that they will ask questions such as, ‘Why are you walking to work?’” says Awilda Caisse, VP, retail sales and strategy manager.

One such customer saved enough money over a year to buy a car outright and was so elated that he brought the vehicle to the branch and had a photo taken there.

“This program empowers customers; they gain more confidence in handling finances, and they are so happy for the support and guidance,” Caisse says. “We are creating remarkable experiences for our customers.”