When autocomplete results are available use up and down arrows to review and enter to select.

The Independent Community Bankers of America® has one mission: to create and promote an environment where community banks flourish. We power the potential of the nation’s community banks through effective advocacy, education, and innovation.

About Community Banks Find a Community BankAs local and trusted sources of credit, America’s community banks leverage their relationship-based business model and innovative offerings to channel deposits into the neighborhoods they serve, creating jobs, fostering economic prosperity, and fueling their customers’ financial goals and dreams.

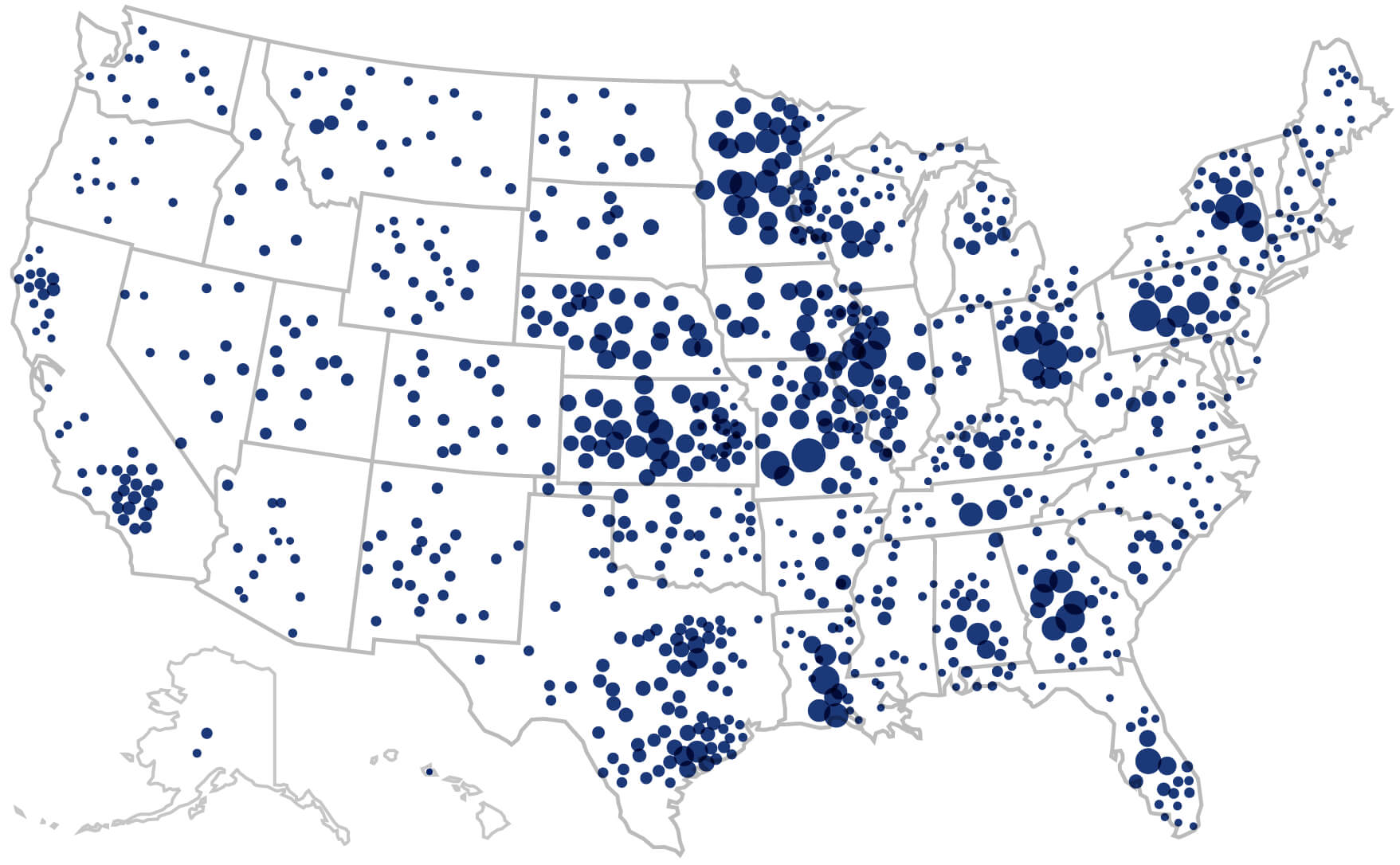

With nearly 50,000 locations nationwide, community banks employ nearly 700,000 Americans and are the only physical banking presence in one in three U.S. counties.

Holding $5.8 trillion in assets, $4.8 trillion in deposits, and $3.8 trillion in loans to consumers, small businesses and the agricultural community, community banks channel local deposits into the Main Streets and neighborhoods they serve, spurring job creation, fostering innovation and fueling their customers' dreams in communities throughout America.

![]()

ICBA engages with members to address challenges faced by community banks of all sizes and charter types. We offer members: national representation, professional development, innovative products and services, and exclusive tools and information.

About Independent Community Banks![]()

Building your community bank business starts with ICBA. Corporate Members agree that ICBA is the first and best resource in their strategy to gain access and visibility to the largest constituency of community banks and decision-makers in the country.

About Service Provider CompaniesICBA’s professional staff draw on a diverse set of skills, expertise and cutting-edge technologies to provide thought leadership in the community banking industry.

The state and regional associations affiliated with ICBA help support community banks across the country. Learn more about your local associations.

See All AssociationsICBA dues are not deductible as a charitable contribution for federal income tax purposes. However, dues may be deductible as a business expense, except for the 20.1 percent of 2024 ICBA dues – whenever paid – that are not deductible, according to the Internal Revenue Code, because of ICBA’s lobbying activities on behalf of its members.

ICBA dues are not deductible as a charitable contribution for federal income tax purposes. However, dues may be deductible as a business expense, except for the 21.1 percent of 2023 ICBA dues – whenever paid – that are not deductible, according to the Internal Revenue Code, because of ICBA’s lobbying activities on behalf of its members.